Racking your brain over how to calculate equipment rental rates? It doesn’t feel like it should be this hard — but it is.

The goal is simple: a rate that’s profitable, competitive, and easy to explain to contractors. In this guide, we’ll break down exactly how to calculate equipment rental rates, how the most common pricing models work, and how to use our free calculator to find your minimum rental rate.

Are you a Party & Event Rental Business? Check out our event rental pricing guide and calculator here!

Types of Equipment Rental Pricing

When you’re figuring out how to price your equipment, you’re really choosing between two pricing models: flat fees and time-based rates. Most rental companies use a mix of both depending on the type of equipment and the job.

1. Flat Fees: Simple, Fast, and Easy to Explain

Flat fees give customers one clear price for a set period — no clock-watching, no guessing. This works best when:

-

The machine has consistent wear and tear

-

Prep time and delivery costs matter more than hours of use

-

You want to avoid customers “stretching the clock”

Why flat fees work in equipment rental:

-

Predictability: Customers know exactly what they’re paying.

-

Fewer disputes: You’re not arguing about whether something was used for 2 hours or 2.5.

-

Better margins on heavy prep: You recover the cost of cleaning, fueling, inspections, and transport

Example:

A tool and equipment rental company may offer flat fees for certain items—like a skid steer or scissor lift—for a day or weekend, regardless of how many hours they’re used. This is because much of the cost (and profit) comes from preparing, delivering, and maintaining the equipment, rather than the actual hours of operation.

2. Structured Pricing: Hourly, Daily, Weekly, Monthly

Time-based pricing scales with the length of time the customer needs the equipment. This is ideal for:

-

Long-term projects

-

Contractor jobs with flexible timelines

-

Smaller tools with low prep cost

The longer the rental, the lower the daily rate — because the equipment spends less time on your lot.

Benefits of structured pricing:

-

Flexibility for customers: They only pay for the time they need.

-

Higher utilization: Long-term rentals keep equipment earning.

-

Better revenue control: You can adjust rates based on demand, season, or job type.

Examples:

You might rent a concrete saw by the hour, a trencher by the day, and a scissor lift by the week or month. A contractor doing a three-month build won’t pay the same daily rate as someone using it for half a day.

What Kinds of Rental Rates are Most Common for Equipment Rentals?

Most successful equipment rental businesses don’t choose one model — they blend them.

A common structure looks like:

-

Hourly rate for small tools

-

Daily rate for most mid-size equipment

-

Weekly rate at ~3–4x the daily

-

Monthly rate at ~2.5–3x the weekly

This pattern rewards longer rentals and keeps you competitive. But your final pricing model depends on what you rent, the upkeep each item requires, local market demand, contractor expectations, and the costs to maintain, deliver, and/or repair the equipment.

How to Do Market Research for Equipment Rental Pricing

Market research for equipment rental pricing is all about knowing these three things with absolute clarity:

-

What equipment renters in your area expect to pay

-

What your competitors are actually charging

-

How demand shifts throughout the year

When you understand these factors, you can set rates that stay competitive without undercutting your margins.

Analyze Your Local Competitors (The Right Way)

Break out that spyglass because it is time to do some digging! Start with your competitors. Ask yourself these questions:

- Do my competitors offer the same inventory I plan to offer?

- What are my competitors charging daily, weekly, and monthly for the equipment I plan to offer?

- What are their damage and cleaning charges?

- Are they booked out weeks in advance?

- Are customers happy with my competitors’ services?

- Can I charge what my competitor is charging, or less, and still come out profitable?

The answers to these questions give you a solid baseline for setting your rates. But remember:

Your competitor isn’t you.

Seeing their prices often triggers the instinct to drop yours, but that’s rarely the right move. You don’t need to be the cheapest shop in town. You just need to offer equipment that’s reliable, well-maintained, and backed by better service.

If your rates are higher, make sure you can justify them with:

-

cleaner, newer machines

-

faster turnaround

-

dependable delivery

-

less downtime

Contractors will pay for equipment that won’t break down on the jobsite.

And one more thing: pricing isn’t the only way to stay competitive. Showing up higher than your competitors on Google, through SEO and Google Ads, often matters just as much as the dollar amount on your rate sheet.

How Seasonal Demand Affects Equipment Rental Pricing

The equipment rental business is highly seasonal, but not in the same way as event rentals. Your pricing can shift dramatically depending on construction cycles, weather, and homeowner project trends.

For tool and equipment companies, this might mean peak demand during construction booms, home improvement seasons, or storm recovery periods. However, you’ll likely see slower months when projects wind down or weather conditions limit outdoor work.

Peak Season for Equipment Rentals

Most equipment rental companies see significant spikes during:

-

Spring and summer construction

-

Storm clean-up and recovery seasons

-

Home improvement booms

-

Municipal or commercial project cycles

Smart Peak-Season Pricing Strategies

During these months, it’s normal for rates to increase. Many rental businesses also pull back long-term discounts and enforce minimum rental periods during peak months.

Another common strategy during peak season is not to raise prices but to boost Google Ads marketing budgets. Peak season is a great time to capture more orders from customers who are searching for rentals online.

When Does Demand for Equipment Rentals Drop?

Every equipment rental business has a slow season — even in high-growth markets. In most regions, demand tends to drop during:

-

Late fall and winter when construction slows or stops

-

Freezing months when concrete, trenching, and earthwork aren’t feasible

-

Rainy seasons that stall outdoor projects

-

Post-holiday periods when homeowners pause DIY spending

In northern and midwestern states, off-season usually runs from November through February.

In southern or warmer climates, the slow period may be shorter, typically December through mid-February.

Storm-prone regions may see an additional dip before the next storm cycle begins.

Smart Off-Season Pricing Strategies

To keep utilization steady when demand dips, many rental companies adjust pricing or packaging by:

-

Compress weekly and monthly rates to attract longer-term projects

-

Offer contractor loyalty or project-based discounts

-

Bundle equipment + delivery to make the offer more attractive

-

Target DIY homeowners with Google Ads for winter projects

-

Promote long-term rentals to reduce idle inventory

The goal isn’t to slash prices, it’s to keep equipment earning and maintain a predictable cash flow.

How To Calculate Equipment Rental Rates

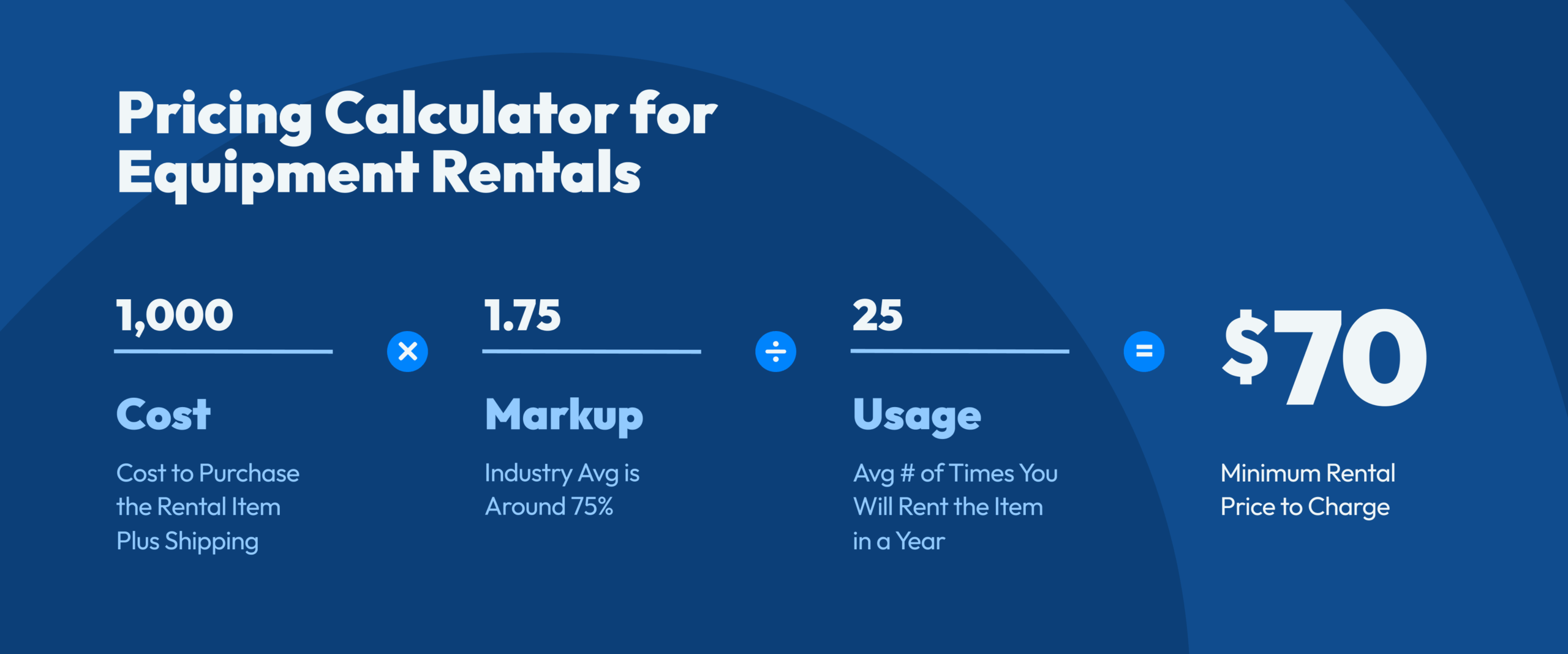

Below is an oversimplified calculator you can use to get started. This will be the minimum daily rental price. Make sure to add in additional costs.

Minimum Equipment Rental Rate Calculator

Please keep in mind that this calculator is a simplified starting point. Your actual rental rate should also reflect your business goals, operating costs, and the realities of your local market.

The formula gives you a minimum daily rate, but you’ll still need to adjust based on factors like:

-

how quickly your equipment wears out

-

how much downtime or maintenance each item requires

-

contractor expectations in your area

-

whether you offer delivery, faster turnaround, or newer machines

Think of the calculator as your foundation. Your pricing strategy is built on top of it.

Want to know how to calculate the ROI on your items? Check out our free ROI calculator here!

Costs to Consider When Calculating Equipment Rental Rates

Every machine in your yard has ongoing costs that must be factored into your rates if you want the business to remain profitable in the long term. Here are the three cost categories that have the biggest impact on your pricing.

What Was Your Initial Investment in the Equipment?

Your initial investment is more than just what you paid for the machine. It includes every dollar spent to get that equipment rental-ready:

-

Purchase price

-

Freight or delivery

-

Assembly or setup

-

Required attachments or accessories

-

Upgrades (better tires, tracks, safety features)

This number determines your recovery timeline — how long it will take for rentals to pay back what you put into the machine.

Most equipment rental companies use a target recovery period (often 18–36 months). Your pricing should support that timeline while still being competitive in your local market.

What Are The Maintenance Costs?

Tools and equipment require constant care. If you’re not pricing for maintenance, you’re not pricing for reality.

Maintenance costs include:

-

Oil changes and filters

-

Hydraulic fluid and hoses

-

Tires, tracks, and wear parts

-

Blade and bit replacements

-

Battery replacement

-

Routine inspections

-

Unexpected repairs

-

Technician labor

-

Downtime (lost revenue when the machine is in the shop)

Some equipment — like trenchers, skid steers, concrete saws, or compactors — wears out fast, especially under contractor use. Others, like ladders or small hand tools, have slower wear but high loss/theft rates.

You should estimate the annual maintenance cost per machine and build that into your pricing. Otherwise, repairs come straight out of your profit.

What Are Your Overhead Costs?

Even when equipment isn’t moving, your business is still spending money. These “overhead” costs need to be supported by your rental rates.

Typical overhead costs include:

-

Yard or warehouse rent

-

Utilities

-

Delivery trucks and fuel

-

Insurance (liability + equipment)

-

Administrative staff

-

Mechanic labor (in-house or outsourced)

-

Marketing and ads

-

Business loans or equipment financing

-

Taxes and fees

These expenses don’t attach to any single machine, but every rental needs to help carry the load.

One of the biggest mistakes new rental companies make is setting prices based only on equipment cost. Your rates must also support the infrastructure required to rent, maintain, and deliver that equipment reliably.

What Is The Equipment’s Lifespan?

Depreciation is one of the most overlooked costs in pricing equipment.

Every piece of equipment in your yard has a limited lifespan. It loses value every month, whether it’s being rented out or sitting on your lot. That loss in value — depreciation — is one of the highest costs you must factor into your rental rates.

Unlike small tools or party items, heavy equipment depreciates quickly:

-

Skid steers, excavators, and trenchers lose value based on hours of use

-

Generators, lifts, and compressors lose value based on age and condition

-

Handheld tools depreciate fast due to wear, loss, or replacement cycles

If you don’t price high enough to recover the equipment’s value before it reaches the end of its useful life, you’ll have to replace it out of your own pocket — not your profits.

How to Estimate the Useful Life of Equipment

Useful life varies depending on the type of equipment and how heavily it’s used:

-

Heavy equipment (skid steers, excavators): 5–7 years or 3,500–6,000 hours

-

Mid-size equipment (lifts, compressors, generators): 5–8 years

-

Small tools (saws, drills, compactors): 2–4 years, depending on wear

-

Consumable-heavy tools (concrete saws, trenchers): shorter effective life due to wear parts

Your rental rate should reflect how quickly each item depreciates and how quickly you need to recover your investment.

A basic formula looks like this:

(Purchase Price – Estimated Salvage Value) ÷ Useful Life (in days or hours)

This gives you the minimum daily depreciation cost you must recover through rentals.

Example:

If you buy a skid steer for $45,000 and expect to sell it for $15,000 after 5 years:

-

Depreciable amount: $30,000

-

Useful life: ~1,825 days

Minimum daily depreciation cost = $16.44/day

That’s just to recover the equipment, not including maintenance, labor, overhead, or profit.

Example: How to Use the Equipment Rental Rate Calculator + Real Costs to Set an Equipment Rental Rate

To make this practical, let’s walk through an example using a popular rental item: a mid-size 3,500-watt generator.

-

Purchase Price (including freight): $1,000

-

Expected Annual Usage: 25 rentals per year

-

Industry-Standard Markup: 1.75

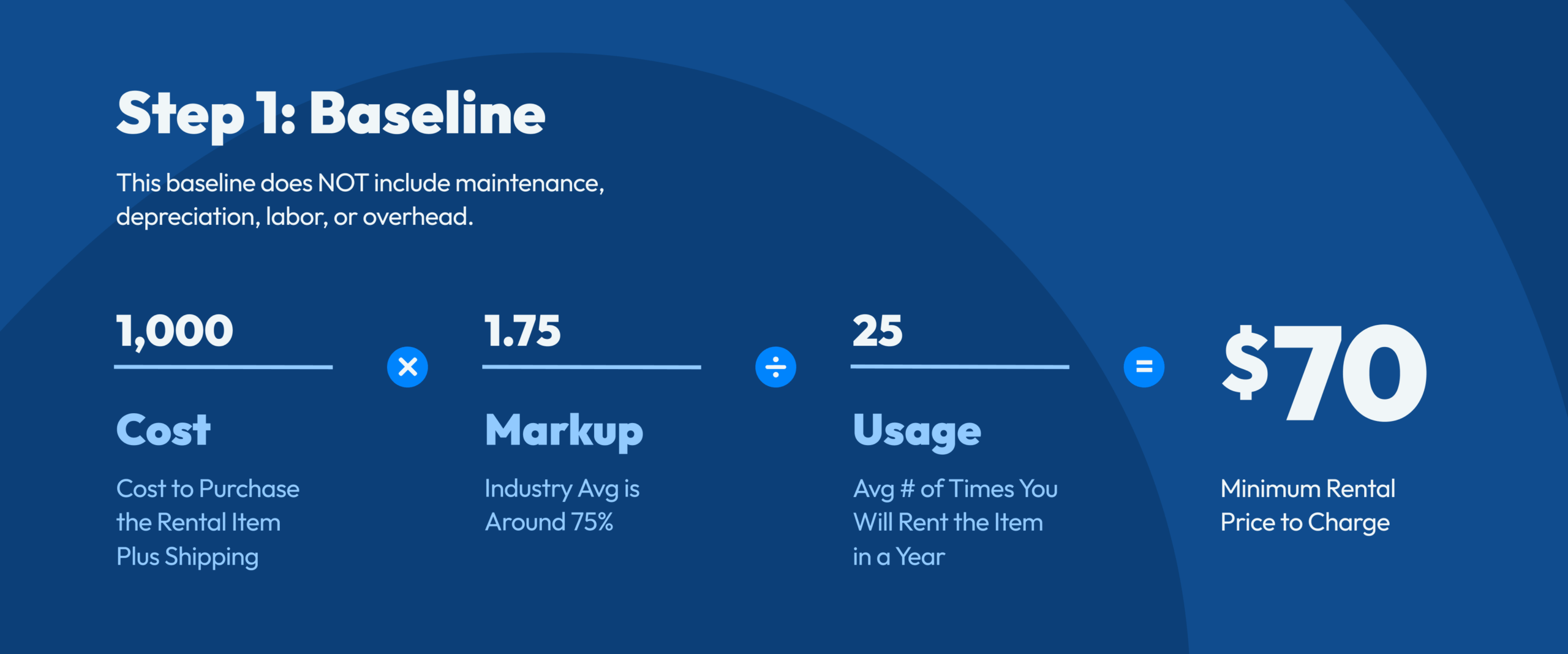

Step 1 — Start With the Calculator Baseline

Using the calculator formula:

Cost × Markup ÷ Usage

$1,000 × 1.75 ÷ 25 = $70/day

This $70/day is your bare-minimum rental price based only on cost, markup, and usage.

Remember, $70/day does NOT cover depreciation, maintenance, overhead, labor, downtime, or replacement.

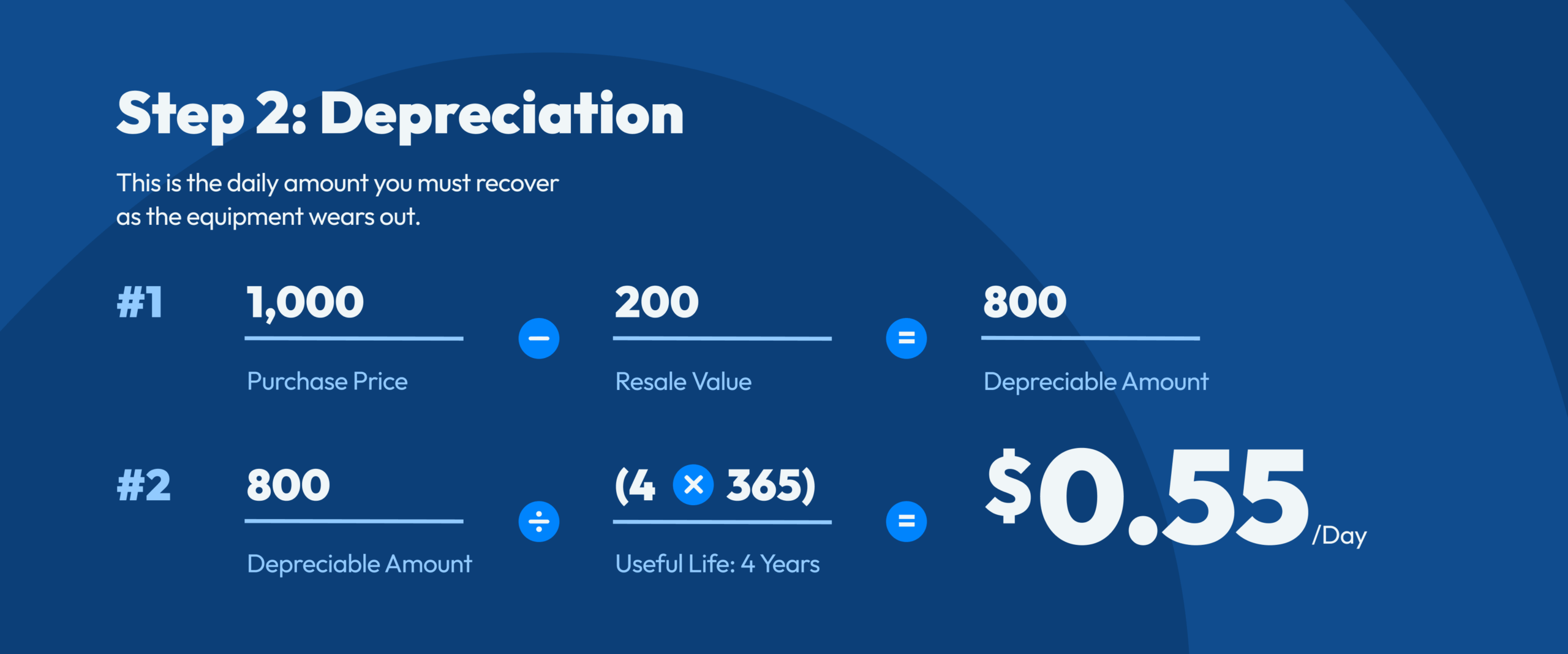

Step 2 — Add Depreciation

Let’s assume:

-

Useful life: 4 years

-

Expected resale (“salvage”) value: $200

Depreciable amount: $1,000 – $200 = $800

Daily depreciation: $800 ÷ (4 × 365) ≈ $0.55/day

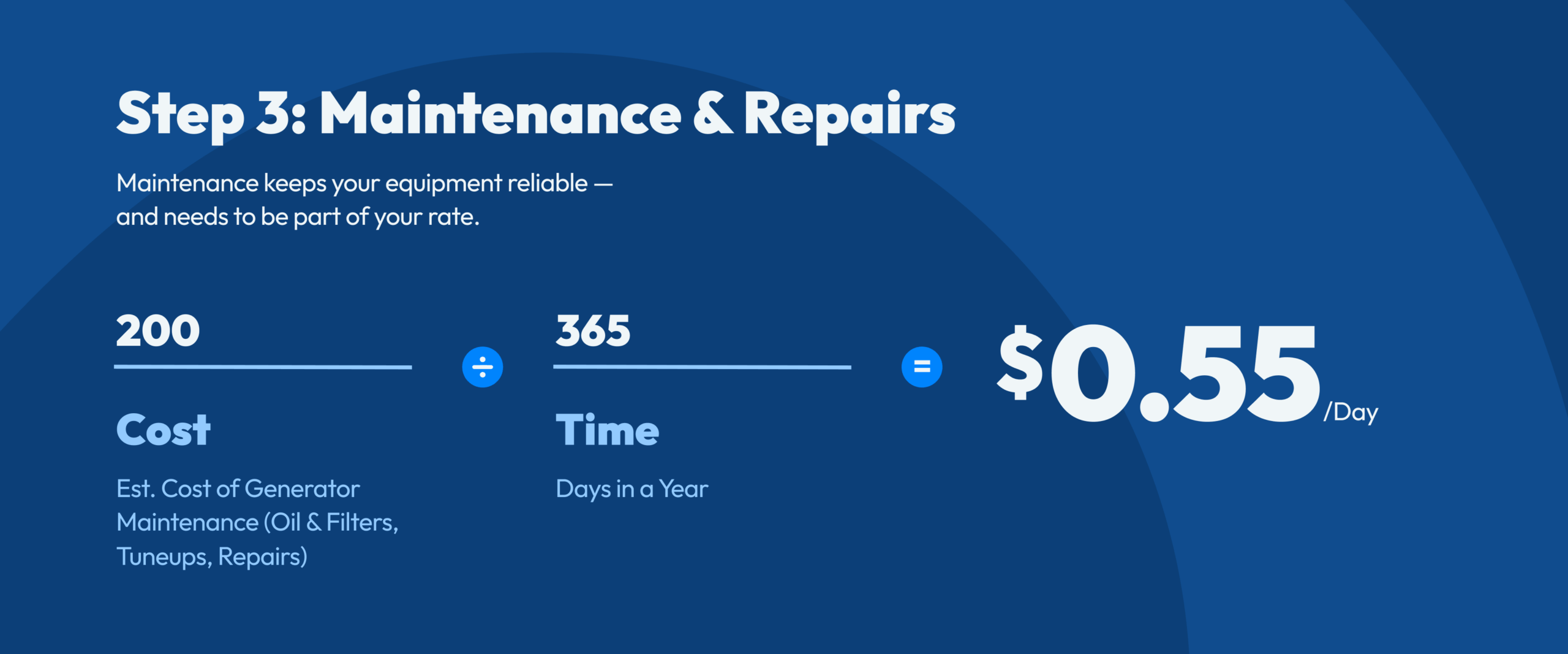

Step 3 — Add Maintenance & Repairs

Generators require ongoing care. A realistic estimate:

-

Oil & filters: $60/year

-

Tune-ups: $40/year

-

Repairs/wear parts: $100/year

Total: $200/year

$200 ÷ 365 ≈ $0.55/day

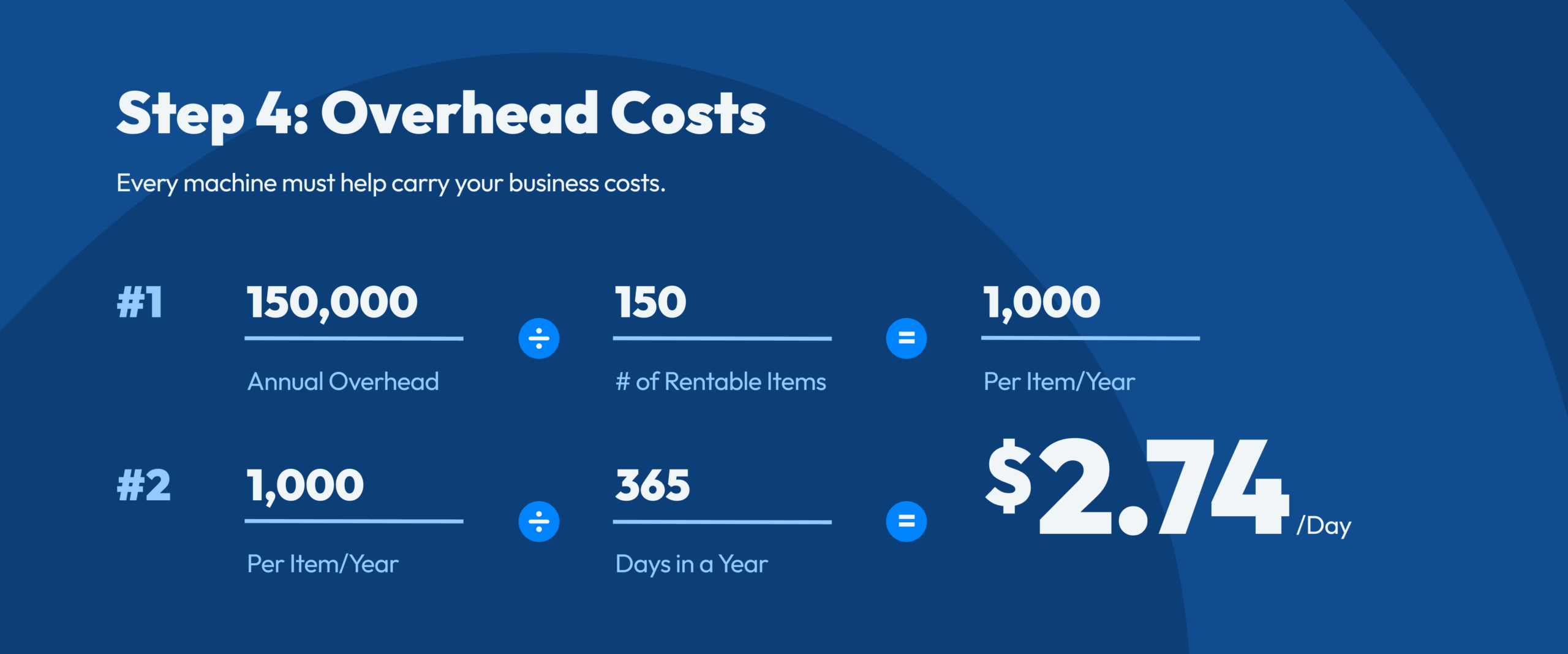

Step 4 — Add Overhead Allocation

Every piece of equipment must help carry your fixed business costs:

-

Yard/warehouse rent

-

Utilities

-

Staff

-

Delivery trucks + fuel

-

Insurance

-

Software

-

Marketing

Example allocation:

If your overhead is $150,000/year and you operate 150 rentable items:

$150,000 ÷ 150 = $1,000 per item per year

$1,000 ÷ 365 = $2.74/day

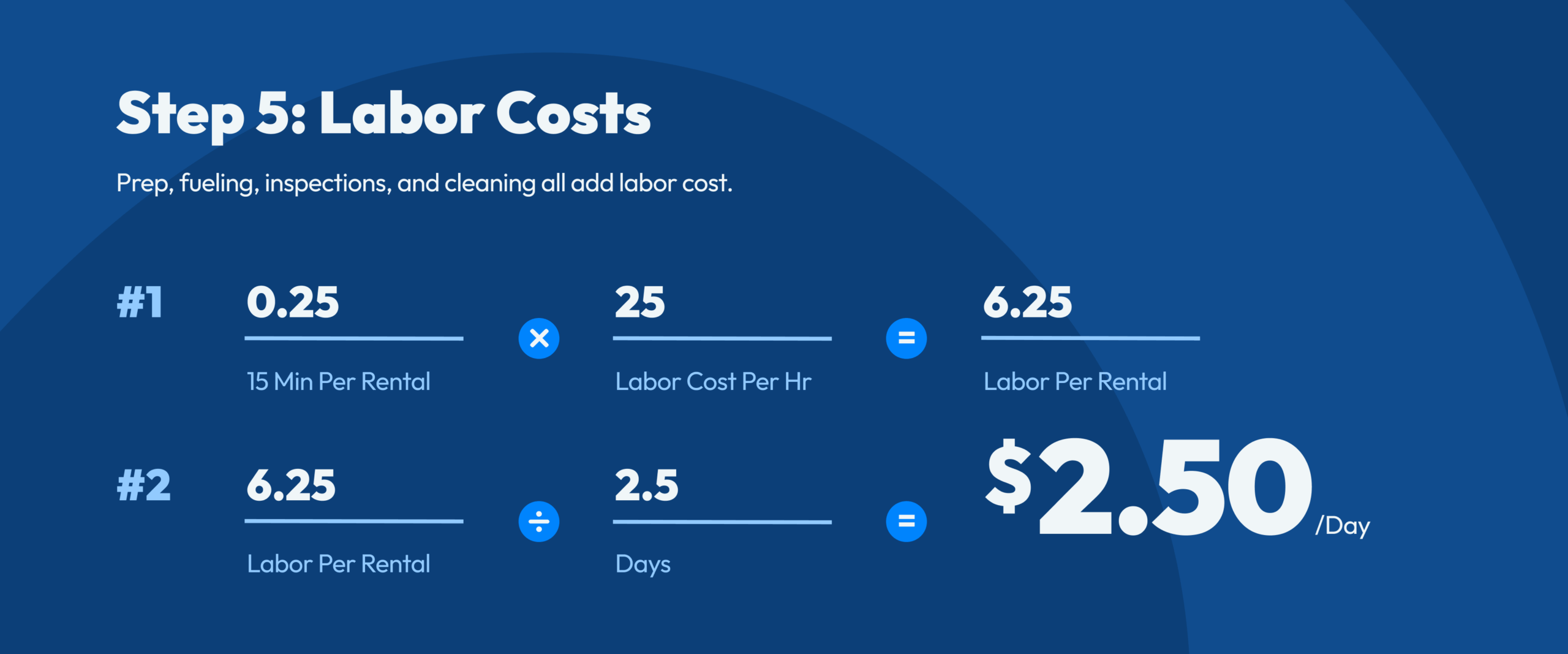

Step 5 — Add Labor for Prep & Turnaround

Let’s assume:

-

15 minutes of staff time per rental

-

Labor cost: $25/hour

-

Average rental length = 2.5 days

Labor per rental: 0.25 hours × $25 = $6.25

Daily labor: $6.25 ÷ 2.5 days = $2.50/day

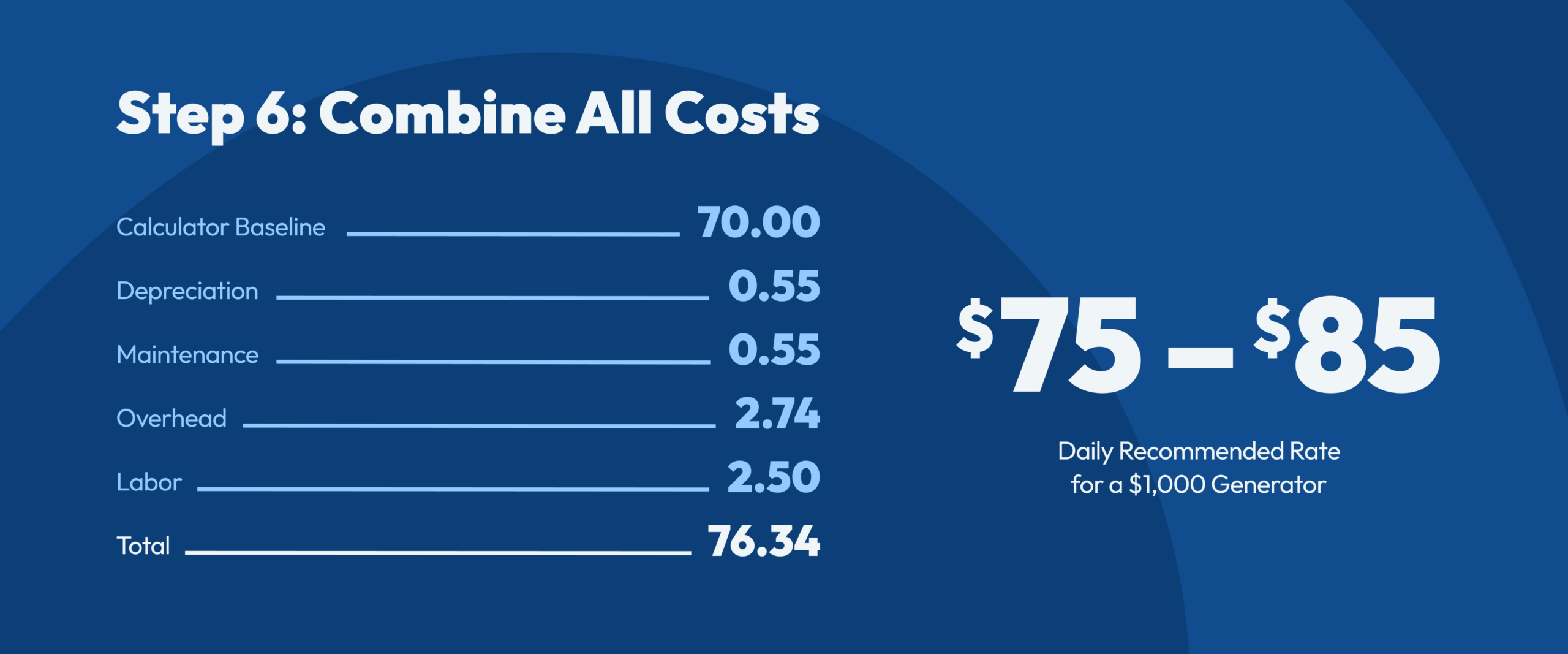

Step 6 — Combine Everything to Get the REAL Rental Rate

Calculator Baseline: $70.00/day

Additional Real-World Costs:

-

Depreciation: $0.55

-

Maintenance: $0.55

-

Overhead: $2.74

-

Labor: $2.50

Total additional cost: $6.34/day

Final Recommended Equipment Rental Rate: $70 + $6.34 = $76.34/day

Round to a clean number contractors expect:

$75–$85/day is a realistic, profitable rental rate for a $1,000 generator.

Best Practices for Setting Rental Rates for Equipment

Now that you understand your true cost to own and operate each piece of equipment, the final step is setting a pricing strategy that keeps your rates competitive and your margins healthy.

Adjust Rates by Equipment Category (Not a Flat % Across the Board)

Different categories behave differently:

-

High-wear items (trenchers, concrete saws, compactors) → require higher daily rates

-

High-value equipment (skid steers, lifts, excavators) → rely on utilization + strong weekly/monthly rates

-

Low-cost items (hand tools) → priced to offset loss, theft, and quick replacement

One pricing model never fits everything.

Review and Update Pricing at Least Once Per Year

Costs change. Markets change. Competition changes.

You should reevaluate rates when:

-

parts, labor, or insurance increase

-

equipment ages or becomes harder to maintain

-

competitors shift pricing

-

demand surges (season or region-specific)

Top companies adjust quarterly, not annually.

Price for Your Market Position (Premium, Standard, or Budget)

Every rental business competes differently.

Ask:

-

Are we the premium operator with newer equipment and fast turnaround?

-

Are we the value option for contractors who just need “good enough”?

-

Are we the specialty shop with hard-to-find tools?

Your pricing should reinforce your positioning — not fight it.

Charge Separately for Delivery & Damage Waiver

This one is huge.

Delivery is not a freebie.

Neither is risk.

Best practice:

-

Delivery fee based on distance or zones

-

Damage waiver typically 10–15% (and highly profitable)

Never bury these costs in your rental rate.

Choose Rental Software Carefully

A great way to maximize your profits and ensure that you are pricing your inventory well is to use a rental software that includes the following:

- Smart reporting features that actually offer insights: A good rental software should provide you with profitability reports as well as payment reports that allow you to gain quick insights into which items are most profitable and who your best customers are.

- Dynamic pricing: Look into rental software that offers dynamic pricing. Dynamic pricing should give you a bit more flexibility when pricing your inventory, including customized and automated pricing adjustments and flexible billing periods (calendar, 31-day, and/or 28-day).

These features are a great way to stay on top of pricing and ensure you get the most out of your items.

Ready to Set Equipment Rental Rates Confidently?

Use the calculator above to run your numbers, then revisit your pricing twice per year to stay competitive.

And if you’d like software that automates pricing, tracks profitability, and manages utilization, TapGoods Tool & Equipment Rental Software gives you the tools to do so effortlessly.

Frequently Asked Questions

You can use a rental calculator to get started, but you need to consider initial investment, maintenance costs, overhead costs, and competitor pricing. There are some general rules of thumb, but simply marking it up based on a percentage of retail cost is too simplistic and your profits will suffer as a result.

Cost of equipment equals initial investment + shipping. Before setting a rental price, you need also factor in overhead cost and competitor pricing.

Rental businesses have about a 50% profit margin with net profits averaging around 15%. Of course this is dependent upon the specific types of rentals and size of the business. Pricing the rentals correctly and making sure you account for labor involved can make a big difference towards your bottom line.