Whether you are a new rental business or have been in the business for years, you want to make sure you are pricing your products so they are competitive with the market while also making a profit. Determining the right rental rates for your inventory is a crucial factor that can significantly impact your business’s profitability, customer satisfaction, and overall growth. You must consider several factors, including market research, equipment acquisition costs, ongoing maintenance expenses, and depreciation. Finding the perfect balance between competitive pricing and sustainable growth is essential for long-term success.

In this guide, we will provide you with practical tips on how to price rental items. We’ll also explore tools available to business owners that make this process a lot easier! Buckle up, because the tips we’ve compiled here will ensure that you can confidently establish pricing models that maximize your business potential.

Types of Pricing & How to Use Them

When considering how to price rental items, the price of rental items, companies employ various pricing models to cater to diverse customer needs and market demands. Two common pricing strategies used by rental businesses are flat fees and time-based prices, each serving different purposes and customer preferences.

1. Flat Fees: Simple and Transparent

Flat fees, also known as fixed fees or one-time fees, provide customers with a straightforward and transparent price on their order(s). With this approach, businesses charge a fixed price for the use of an item or service, for a set rental duration. Flat fees are commonly applied to rental items or services that have consistent costs and are typically used for shorter periods.

Advantages:

- Clarity for Customers: Flat fees offer clear and predictable pricing, making it easy for customers to budget and plan their rental expenses.

- Operational Efficiency: Both customers and rental businesses benefit from the simplicity of flat fees, streamlining the rental process and reducing administrative complexities.

Examples:

- A party rental company may charge a flat fee for a 4 hour rental.

- An audiovisual equipment rental company may offer flat fees for renting projectors for an event regardless of the duration of the event because they make a significant portion of their profit from the service to set up and take down.

2. Structured Pricing

Structured pricing is a tiered, time-based option whereby the fees gradually decrease for longer rental periods. This approach offers customers flexibility, allowing them to rent items for precisely the amount of time they need. Time-based pricing is commonly used for items rented for more extended periods or when the rental business incurs variable costs based on the rental duration.

Advantages:

- Customizable Rentals: Time-based prices cater to customers’ varying needs, enabling them to rent items for the specific duration required for their events or projects.

- Revenue Optimization: Rental businesses can adjust time-based prices to capitalize on peak demand periods, increasing their revenue potential.

Examples:

- A party rental company may offer daily rates for tables and chairs to accommodate multi-day events. The weekly rate may be equal to three days and the monthly rate could be equal to two weeks. The daily rate decreases as the time is extended.

- An equipment rental company may have hourly rates for customers who only need power tools for a few hours or monthly rates for projects that take longer.

Most rental companies offer a combination of flat fees and structured pricing, tailoring their approach to suit their inventory’s nature and customer preferences. Considerations such as the type of rental items, market demand, customer preferences, and competitors’ pricing should all play a role in determining the optimal pricing strategy.

Market Research for Rental Pricing

Market research, in the context of a rental business, is the process of gathering and analyzing information related to the rental market, customer preferences, and competitor rates. It involves collecting data that helps understand the dynamics of the rental market and identify customer expectations. By conducting market research, rental companies can make informed decisions when considering how to price rental items, expand their inventory, and improve overall business performance.

Market research allows you to dive deep into the minds of potential customers, giving you insight into their preferences and expectations. By analyzing competitor pricing, you can discern what price points customers find reasonable for specific products and services. This knowledge will help you strike the right balance between affordability and perceived value, setting your rental business on a course towards customer satisfaction.

Spy on your Competitors

Break out that spy-glass, because it is time to do some digging! Understanding how your competitors price similar products is a critical aspect to ensure that your prices stay competitice.

Whether you choose to match the competition’s prices or highlight the added value you provide, researching how your competitors price similar inventory to yours will inform your pricing decisions and steer you towards a favorable position in the market.

Take Advantage of Seasonal Markets When Pricing Rental Items

As the demand for rental items fluctuates with different times of the year, adjusting prices during peak and off-peak seasons can be a game-changer for maximizing revenue and enhancing customer satisfaction. For instance, certain rental items may be in high demand during holidays, festivals, or the wedding season, while experiencing lower demand during quieter months. By understanding seasonal demand patterns, rental companies can strategically plan their pricing adjustments.

Peak Season Pricing

During peak seasons when demand for rental items is at its highest, rental companies have the opportunity to set higher prices. Customers are often willing to pay a premium to secure the items they need for their special events or projects. Higher prices during peak periods not only capitalize on increased demand but also help ensure that inventory remains available for those willing to pay the premium.

Advantages:

- Increased Revenue: Charging higher prices during peak seasons allows rental businesses to maximize revenue when demand is at its peak.

- Enhanced Inventory Management: Premium pricing can help manage inventory availability during busy periods, preventing overbooking and maintaining excellent customer service.

Off-Peak Season Pricing

During off-peak seasons, when demand is lower, rental businesses can adopt more competitive pricing strategies to attract customers. Lower prices can entice clients who are cost-conscious or planning events during less busy times of the year. By offering attractive rates during off-peak periods, rental companies can increase their bookings and revenue during traditionally slower times.

Advantages:

- Attracting Customers: Competitive pricing during off-peak seasons can draw in customers who may have been deterred by higher prices during peak periods.

- Maximizing Utilization: Offering lower prices during slower periods encourages customers to rent items, increasing overall equipment utilization.

How To Calculate Rental Item Prices

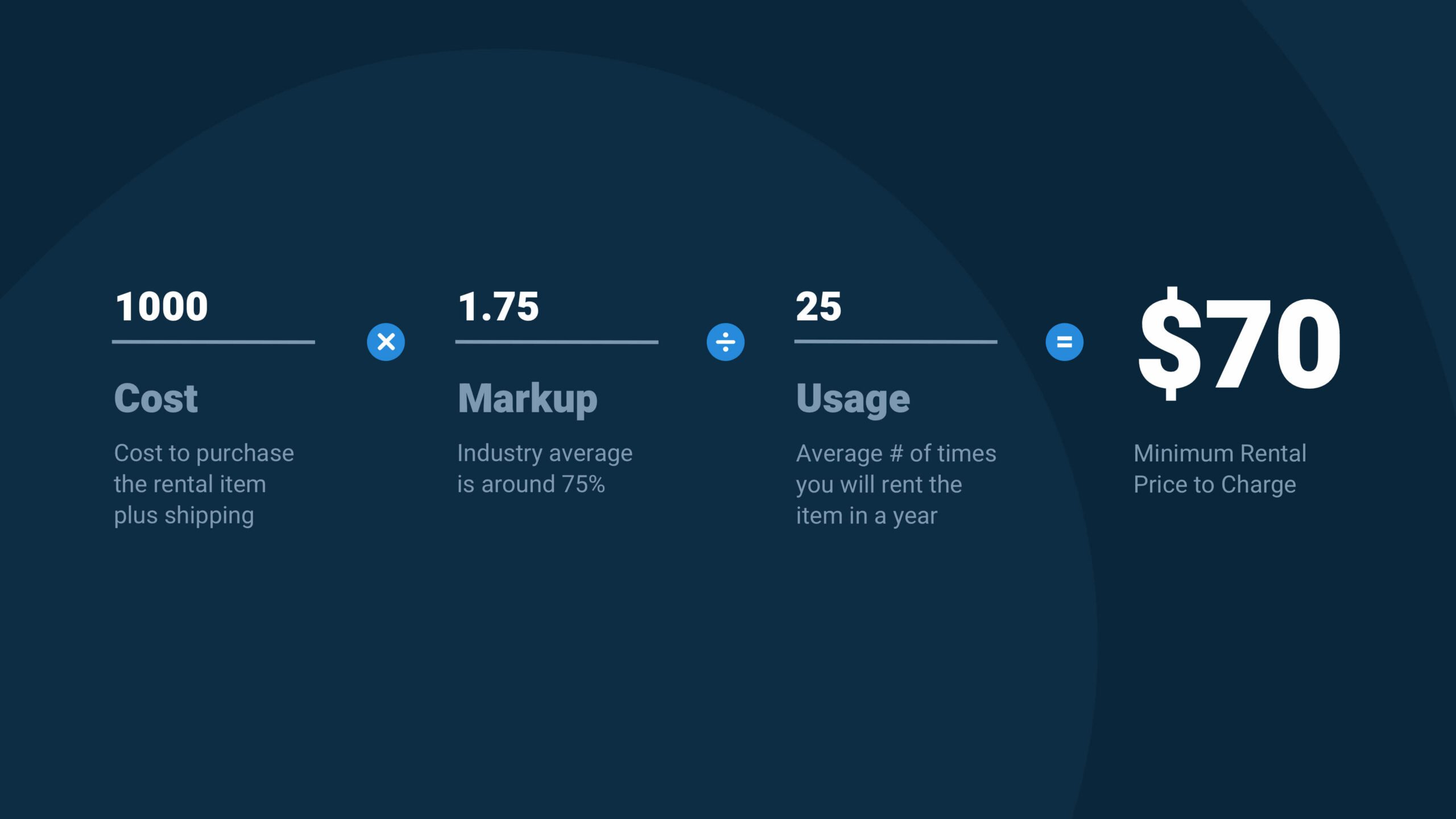

Below is an oversimplified calculator you can use to get started. This will be the minimum daily rental price. Make sure to add in additional costs.

Please keep in mind that the above calculations are simplified and that you should consider your own business goals and needs when considering how to calculate the rental rate for equipment and other types of items.

This calculator is meant to give you a jumping-off point and shows one way that businesses can calculate pricing on an item. You must factor in market research and your company’s positioning strategy. For example, if your company offers white glove service, you should price it at a premium. Or, if your target audience is more price-conscious, you may want to lower the expectations for the service provided.

Other costs that need to be considered

Initial Investment

Calculating the initial investment in your rental items lays the groundwork for a sustainable pricing strategy that ensures your business’s profitability. This includes the purchase price of the equipment, any associated shipping and handling costs, and any additional fees required for setup or installation.

By understanding the total investment you’ve made in your rental items, you can determine the minimum price point needed to cover these acquisition costs.

Maintenance Costs

You need to consider the maintenance of your inventory. Keeping your inventory in top-notch shape costs money; this is especially true for the tools and equipment industries. Regular maintenance, routine inspections, and occasional repairs are all part of the ongoing upkeep expenses.

To ensure your pricing remains competitive and sustainable, calculate the annual maintenance and repair costs for each item in your inventory. Incorporate these costs into your pricing structure to ensure you can cover these expenses while providing well-maintained equipment to your customers.

Overhead Costs

Running a successful rental business entails more than just acquiring inventory and setting rental rates. Behind the scenes, there are various “overhead costs” that keep the operations afloat and the business running smoothly. These expenses include rental facility costs, administrative expenses, insurance premiums, marketing efforts, and general operating costs.

From maintaining a well-equipped rental space to ensuring seamless customer interactions, these overhead costs are the backbone of a thriving rental company. Factor in these expenses when calculating rental prices to ensure that the pricing strategy remains financially sound, competitive, and sustainable.

Best Practices for Pricing Rental Inventory

Offer Bundling & Discounts

Bundling inventory refers to combining related rental items or services into attractive packages. By bundling complementary items together, rental businesses create compelling offers that cater to various customer needs. Whether it’s a party package that includes tables, chairs, and decorations, or a multimedia bundle comprising projectors, screens, and sound systems, customers are drawn to the convenience and cost-effectiveness of these all-in-one solutions.

Offering discounts based on rental duration, bulk orders, or seasonal promotions encourages customers to choose your rental business over competitors. Whether it’s a percentage off for longer rental periods or special deals during slow seasons, discounts demonstrate your commitment to customer satisfaction while boosting your rental business’s competitiveness.

By combining bundling and strategic discounts, you can create a cutting-edge pricing strategy that caters to diverse customer preferences and fosters loyalty when customers feel like they are getting a good deal.

Gather Feedback from Customers

Before finalizing your rental prices, consider testing different pricing strategies or conducting a pilot run to gather feedback from customers. Monitor the performance of your pricing strategy and be prepared to make adjustments based on customer responses and market trends.

This can be done through surveys, focus groups, or one-on-one interviews. Ask customers about their perception of the pricing, whether they find the rates fair and competitive, and if the value provided meets their expectations.

Customer feedback is invaluable for understanding how the pricing strategy aligns with customer needs and preferences. It can reveal potential pain points, areas for improvement, and opportunities for further customization.

Set Fair and Realistic Profit Margins

While it may be tempting to set rental prices as high as possible to maximize revenue, this can lead to alienating price-sensitive customers and negatively impacting your business. Instead, use the data from these cost analyses to set fair and competitive rental rates. Factor in your business goals, target customer base, and desired profit margins to arrive at a pricing structure that ensures customer satisfaction while ensuring your business remains profitable in the long run. It is a good idea to add labor as a separate line item. That way, you can capture price-sensitive customers, and you can offer high end service to those willing to pay for it.

Striking the perfect balance between generating revenue and offering competitive prices can be challenging, but it is essential for maintaining customer loyalty and business growth. Setting realistic profit margins involves considering the costs of acquiring and maintaining inventory, overhead expenses, market research insights, and customer value perception.

By understanding the competitive landscape and aligning pricing strategies with customer needs, rental businesses can confidently set profit margins that not only support business growth but also provide value to their customers.

Other blogs you may find helpful:

Frequently Asked Questions

You can use a rental calculator to get started, but you need to consider initial investment, maintenance costs, overhead costs, and competitor pricing. There are some general rules of thumb, but simply marking it up based on a percentage of retail cost is too simplistic and your profits will suffer as a result.

Cost of equipment equals initial investment + shipping. Before setting a rental price, you need also factor in overhead cost and competitor pricing.

Rental businesses have about a 50% profit margin with net profits averaging around 15%. Of course this is dependent upon the specific types of rentals and size of the business. Pricing the rentals correctly and making sure you account for labor involved can make a big difference towards your bottom line.