3 Things (Besides Money) That Show a Business Is Doing Well

You’ve heard the old saying, “Money isn’t everything,” right? Well, guess what? It’s true even in the business world. Sure, having a nice chunk of change in the bank feels great, and is a big thumbs-up for your business. But, hold on! There’s more to success than just cash.

In this article, we’re diving into five signs that signal your business is rocking it – and nope, not a single one involves your wallet. So, if you’re curious about whether your business is doing well, you’re in the right spot.

- Your Customers Are Engaged and Happy

- Your Employees Stick Around

- Your Social Media Presence Is Growing

Finances Aren’t The Tell-All of Success

First off, let’s talk about why these metrics should be on your radar. I know, I know – you might be thinking, “Money talks, so why bother with anything else?” Well, here’s a little secret: these non-financial metrics directly link to whether you’re on the path to making more money or if you’re heading towards a bump in the road.

Now, we’re not saying to forget about your finances. That’s not it at all. Money problems are a big reason some small businesses don’t make it. It’s super important to watch your finances closely and check them often. But, looking at your money alone doesn’t show you the whole picture.

Think of your finances as a snapshot of where your business stands today. They show you how much money you have, but they don’t explain why your numbers look the way they do or how you can boost your profits. That’s where non-financial metrics come in. They offer a deeper look into your business’s health and guide you in making choices that can lead to more money in the bank.

1. Your Customers are Engaged and Happy

One huge way to tell that your business is on the road to success is to take a look at what your customers are saying and feeling about your business. When customers are happy, they’re more likely to return and bring new customers with them.

How Can You Tell If Your Customers Are Happy?

1. Check your ratings on Yelp and Google Business. These platforms offer star ratings and reviews which can give you a snapshot of customer opinions.

Higher ratings and positive comments usually reflect customer satisfaction. Be proactive in responding to both positive and negative reviews to show that you value customer feedback.

2. Search for your business on social media sites like Facebook and Instagram, and see what people are saying. Social media is a spot where folks go to express what they think about your store or service.

Keep an eye out for any shout-outs, tags, or comments about what you do. When you see people talking about your business, jump into the conversation! Say thanks when they say good stuff, and if they have a problem, help them out. This is how you make a great vibe around what you do and get everyone feeling good about your business.

3. Your customers are expressing gratitude and recommending you to their friends and family. When folks really like what you’re doing, they’ll often tell others about it. Watch for more people sending their buddies your way or giving you a shout-out on your posts. That means they’re not just okay with what you’re offering — they’re cheering for it!

What Do I Do If My Customers Are Unhappy?

Uh-oh, so you’ve stumbled on some less-than-stellar reviews or some not-so-nice comments on Facebook. It’s a bummer, right?

You might be scratching your head, thinking, “What can I do to make things right?” Well, here’s what you can do right now if you find some customers who aren’t thrilled with what you’ve done:

Respond to any low reviews with grace.

It’s important to stay cool and kind when you reply to reviews that aren’t what you hoped for. It’s a chance to show that you’re open to feedback and dedicated to continuous improvement. A kind response can help ease tensions and may even convert a dissatisfied customer into a loyal fan.

Example response:

“Hi [Customer Name], thank you for taking the time to share your experience. We’re truly sorry to hear that things didn’t go as you expected.

We take your feedback seriously and want to make things right. Please reach out to us at [your contact information]. We’d love the opportunity to show you the quality service we’re known for.”

Reach out to the customer directly.

Reaching out to a customer directly can turn a negative experience into a positive one. It demonstrates that you’re not just monitoring feedback passively but are actively engaging to resolve issues. This approach not only can mend a specific customer relationship but also enhances your reputation as a responsive and caring business.

Example of Direct Outreach:

“Hello [Customer Name], this is [Your Name] from [Your Business]. I saw your feedback and I’m sorry to hear about your recent experience with us. I would love to discuss this further and see how we can make things right.”

This one is simple: Apologize!

Apologies can significantly improve a customer’s experience. Research shows that while only 34% of unhappy customers who received compensation felt satisfied, the satisfaction rate soared to 74% when businesses apologized for a negative experience. Saying sorry can deeply impact how customers feel about resolving their issues.

Here’s an example of a good apology that demonstrates understanding, responsibility, and a commitment to making things right:

“Dear [Customer Name],

I’m truly sorry that your experience with [Product/Service] did not meet your expectations this time. We always aim to deliver a great experience; in this case, we fell short. We take full responsibility for any inconvenience this may have caused.

Please know that we are looking into this issue to prevent future occurrences, and would love the opportunity to discuss how we can make this right for you. Your satisfaction is very important to us, and we would like the chance to resolve this.

Thank you for bringing this to our attention. I hope to hear from you soon.

Warm regards,

[Your Name]

[Your Position]”

2. Your Employees Stick Around

Employee satisfaction is a key indicator of your business’s success. High employee turnover can be a major expense and could ultimately hurt your profits and overall financial health. Replacing an employee isn’t just about filling a spot; it can cost double or triple their salary. Plus, frequently losing your product experts, or not having any long-term experts at all, can really affect the quality of what you sell.

Happy employees tend to be more engaged, productive, and committed to the company’s goals. This stability not only saves on the high costs associated with hiring and training new staff but also builds a more knowledgeable and experienced team. As a result, businesses with low employee turnover often see improved performance and customer satisfaction, contributing to long-term success and growth.

How Can I Find Out If My Employees Are Happy?

- Conduct Anonymous Surveys: Regularly distribute anonymous surveys to gather honest feedback about the workplace environment, culture, management practices, and job satisfaction. Use straightforward questions and include a mix of quantitative scales and open-ended questions to capture detailed sentiments.

- Hold One-on-One Meetings: Schedule regular one-on-one meetings with employees to discuss their experiences, challenges, and any concerns they might have. This direct communication can help identify issues before they escalate and shows employees that their input is valued.

- Implement a Suggestion Box: Set up a physical or digital suggestion box where employees can freely share their ideas for improvements or express concerns. This method provides another avenue for anonymous feedback, encouraging open and honest communication without fear of repercussions.

What Should I Do If My Employees Are Unhappy?

When employees say they’re unhappy, employers need to act quickly and effectively. Here’s what you can do, step by step:

- Acknowledge and Validate Their Feelings: Quickly let your employees know that you hear them and you take their concerns seriously. This shows you respect their feelings.

- Investigate the Issues: Find out what’s causing the unhappiness. You might need to talk more with employees, look at how things are done in the workplace, or check the working conditions.

- Develop an Action Plan: Create a clear plan that responds to the problems you found. This might include changing some rules, starting new programs to support employees, or changing how things are managed.

- Implement Changes: Put the necessary changes into place. Make sure you tell your employees what you are changing and why. It is important to act quickly so your employees can see you are serious about improving things.

- Follow-Up: After making changes, check back to see if things have gotten better. You can do this by asking for more feedback or having more one-on-one talks.

- Foster an Ongoing Dialogue: Make sure there are always ways for employees to talk about their concerns and ideas. This helps keep small problems from getting bigger and makes the workplace better for everyone.

These steps show that you care about making your workplace better and respect your employees’ input, which can help improve morale and productivity.

3. Your Social Media Presence is Growing

Seeing more people interact with your social media is a great sign that your business is doing well. Here’s how you can tell your social media presence is growing:

- You have more followers. Gaining followers means that more people are discovering your business and are interested in staying updated with your content. It’s a sign that your marketing efforts are working and that your business is appealing to a broader audience. This increase in followers can lead to greater brand awareness and potentially more customers as more people get exposed to your products or services.

- You notice more engagement in your posts. When more people like, comment on and share your posts, it means they really enjoy your content. This shows that not only are people seeing what you post, but they like it enough to interact with it. More interaction on your posts helps improve your brand’s visibility on social media. This is because social media algorithms often show posts that get a lot of interaction to more people. This means your posts are more likely to be seen by others.

- Customers are tagging you in their posts. When customers tag your business in their posts, it means they really like your products or services. This kind of post from a customer can influence others more than a regular ad because it’s like a personal recommendation. You can also share these posts to show how other customers are enjoying your products, which might convince new customers to buy from you.

What Do I Do If My Social Media Isn’t Doing Well?

If your social media pages are not doing well, it’s time to re-evaluate what actions you are taking to increase traffic. Here’s what you can do to increase your engagement on social media:

- Like and comment on your customer’s posts. If a customer shares photos of an event where they used your rental equipment, make sure to like and comment on their posts. This not only helps get your name out there but also shows your customers that you value their business and are engaged in their experiences.

- Increase your posting frequency. It might seem simple, but posting more often is essential. The ideal number of posts per day varies by platform, so it’s important to stay active and consistent to build your following and enhance your visibility.

- Engage your audience with interactive content. Use polls, questions, or interactive posts to engage your followers. This type of content can encourage more interaction and participation from your audience, making your social media pages more lively and attractive.

Never Stop Striving – Success Is Around the Corner

Remember, true success is measured not just by the cash flow but by the positive impacts your business creates: happy customers who become brand ambassadors, loyal employees who grow with your company, and a social media presence that resonates and engages.

So keep nurturing these aspects, listening to feedback, and adapting, because these are the real signs that your business isn’t just surviving—it’s thriving.

Other blogs you may find helpful:

5 Reports that Rental Businesses NEED to Review Frequently

The Importance of Equipment and Party Rental Contracts in 2024

A Step by Step Guide to Becoming a Preferred Vendor at an Event Venue

Frequently Asked Questions

Your business is doing well if your customers are happy and returning, your employees are sticking around and satisfied, and your social media presence is growing. These factors show that your business is thriving beyond just making money.

Look at online reviews and ratings on platforms like Yelp and Google Business. Also, check your social media for customer comments, tags, and shares. Positive feedback and active engagement on these platforms are good indicators that your customers are satisfied.

You can gauge employee happiness by conducting anonymous surveys, holding one-on-one meetings, and providing a suggestion box for feedback. Low turnover and positive feedback from these channels suggest that your employees are content.

To boost your social media engagement, increase your posting frequency, interact with your customers’ posts, and use interactive content like polls and questions. These actions can help attract more followers and encourage more active participation from your audience.

How Much Should Rental Companies Charge for Labor?

Starting a rental business comes with its fair share of head-scratchers, and figuring out how to price your stuff – especially what to charge for labor – tops the list. Why? A couple of reasons. First, math is hard. It’s even tougher when you need to balance covering your overhead and labor costs, making a profit, and trying not to scare your customers away. Sometimes, figuring this part out can cause stress for business owners or feel downright impossible.

And yet, getting this part right is crucial for your rental company’s success. So what do you do? In this blog, we’ll dive into common approaches taken to pricing labor and share some tips and tricks that will help you hit that perfect balance!

- Common Approaches to Pricing Labor

- Understanding Labor Costs

- Calculating Labor Price

- Break Even Analysis

- How Much Should Rental Companies Charge for Labor?

Common Approaches to Pricing Labor

When it comes to pricing your labor or services, there are a few factors you must always consider:

- How much does the service cost your business?

- What do customers think the service is worth?

- How much are your competitors charging?

Since these three questions are so important, they are the pillar points for the most common approaches to pricing labor in the rental market.

Cost-Based Pricing

Figure out how much the labor costs your business. Do you pay your workers an hourly wage? Do your workers have to use a company vehicle to perform the service? What tools do you use for the service, and how much did it cost to acquire them?

Crunch these numbers. It is extremely important to understand what a service is costing you because you will always need to charge more than it costs to perform the labor.

Value-Based Pricing

Do some research and figure out how in-demand the service is. Is it a premium service that customers are willing to pay more for, or is it something that doesn’t take much skill? This is also known as “Value Based Pricing”, which means that you price the service according to market worth.

Competitor-Based Pricing

Do some digging and find out what your competitors are charging. While you don’t always need to charge less than competitors – the saying goes, “You get what you pay for” – it is good to know whether your prices are significantly different. When you know how much competitors are charging, you can re-evaluate your pricing strategy to make sure that it is competitive.

What Approach Is The Best?

The best approach to pricing takes all three of the above factors into account.

If you charge more than a customer believes the service is worth, they won’t order from you. If you charge too low, they may not order from you because they fear your work will not be quality.

And if you don’t consider your competitors’ prices, you may lose out if their packages are more attractive.

But ultimately, understanding your labor costs is inarguably the most important factor to consider if you want to avoid losing money.

Understanding Labor Costs

This gets tricky in a rental company where everyone does a variety of tasks, from counting inventory to chatting with customers. It’s not as straightforward as a factory job where someone earns a set wage for repeating the same task. Each order and day brings new challenges, making it tough to pin down your exact costs.

There are two types of costs you should account for:

- Fixed Costs: These are expenses that stay the same, no matter how many orders you receive. Fixed labor costs include managers’ salaries, guaranteed hours for employees, and employee benefits.

- Variable Costs: These costs go up as you get more orders. Examples of variable labor costs include the time it takes to prepare orders, deliver them, and set up or take down items for customers.

Why Fixed and Variable Expenses Matter

Your labor expenses combine both fixed and variable costs. You’ll have fixed costs even if you don’t process any orders, and your variable costs will rise with the number of orders you handle.

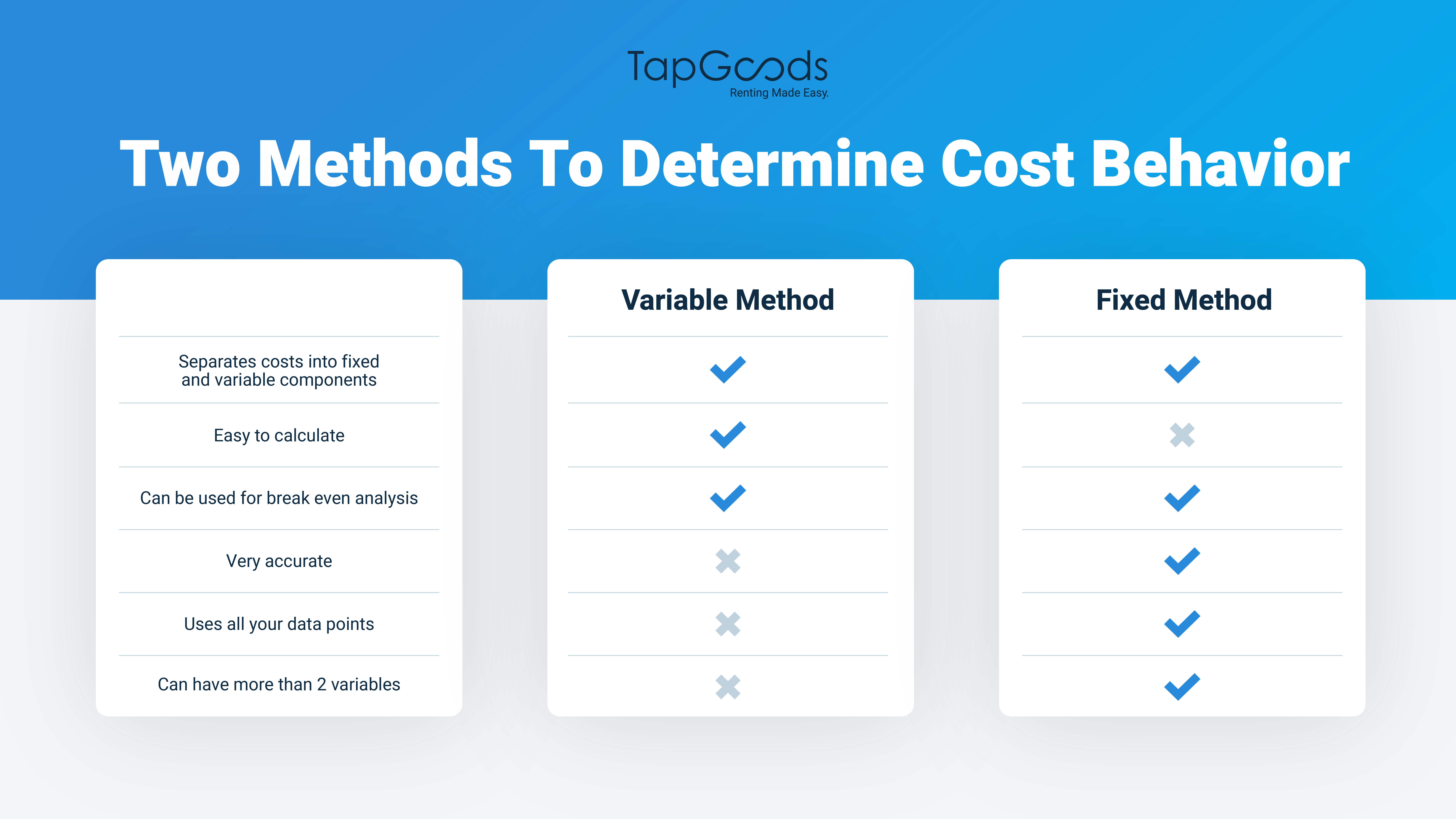

To figure out your costs, start by separating fixed and variable costs. You can use historical data and choose from two methods to determine the ratio of fixed to variable costs. Remember, these methods are most effective within a certain scale. Scaling your business significantly, like going from a $1 million company to a $10 million company, will alter cost behavior.

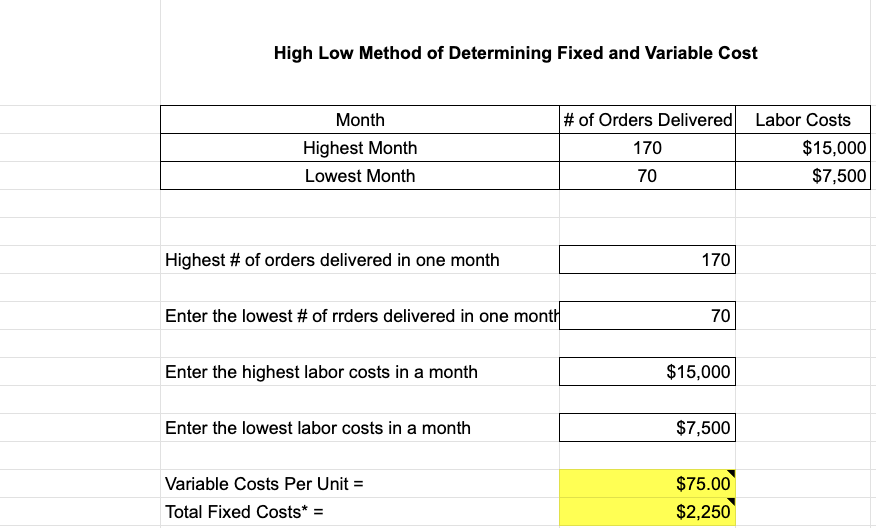

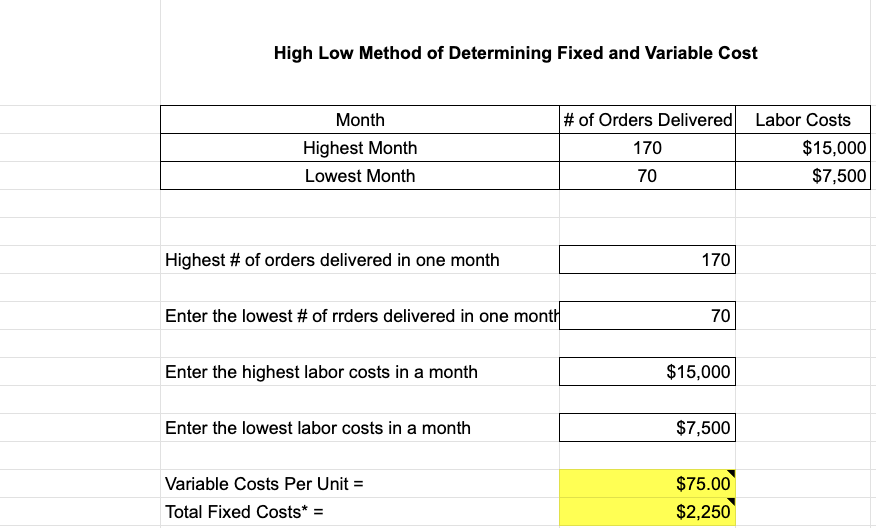

- High-Low Method: This simple method uses just two data points—your highest and lowest costs—to break down costs into fixed and variable components. It’s straightforward but less precise.

- Linear Regression Method: This method is more complex and accurate. It analyzes all your data points to distinguish between fixed and variable costs.

While I won’t dive deep into the mathematics behind these methods here, I’ve prepared a spreadsheet that simplifies the process. The spreadsheet comes with explanatory notes to help you understand how the calculations work.

Calculating Labor Price

Gather Your Data

Start by gathering your labor cost data. I recommend using at least 12 months of data for accuracy but be mindful not to use data so old that it doesn’t reflect current labor cost trends, as these costs tend to increase over time. Then, note how many orders you processed each month.

Here’s some fictional data for our example:

| Month | # of Orders Delivered | Labor Costs |

|---|---|---|

| Jan | 100 | $9,000 |

| Feb | 70 | $7,500 |

| Mar | 150 | $14,000 |

| Apr | 120 | $8,500 |

| May | 130 | $12,500 |

| Jun | 110 | $9,000 |

| Jul | 90 | $7,500 |

| Aug | 140 | $12,000 |

| Sep | 160 | $10,500 |

| Oct | 170 | $15,000 |

| Nov | 115 | $8,200 |

| Dec | 80 | $7,000 |

How to calculate your variable costs

Compare the highest and lowest cost months. The difference is your total variable cost. For example, the variable cost increase is $7,500 from a change of 100 orders, making the variable cost per unit $75.

In mathematical terms, variable cost per unit equals the change in costs divided by the change in orders. Our spreadsheet can automatically calculate this for you.

How to calculate fixed costs

take the total costs at the highest point ($15,000) and subtract the variable cost component ($75 variable cost per unit * 170 orders = $12,750).

The remaining $2,250 represents your fixed costs. Again, you can use our spreadsheet to calculate this data!

Segmenting Costs

To figure out your costs accurately, you need to look at different parts of your business separately. For jobs related to labor in rental companies, think about breaking it down like this:

- Pickup Orders: This is when the cost to get orders ready should be included in the price you charge for renting out items.

- Delivery Orders: Think about the cost of just delivering items.

- Delivery Orders with Setup: This is when you deliver items and also set them up. This should be its own category because it involves more work.

You can also split delivery orders into more specific groups. For example, orders with lots of items versus orders with just one item, or orders where you set up tents versus orders where you set up chairs. The more you break down these categories, the better you can understand your costs.

High-Low Method

The High Low Method uses two data points—the highest and lowest—to estimate costs, ignoring other data. This method may not fully capture your business model’s nuances. For instance, if these points are outliers, they won’t provide a useful analysis.

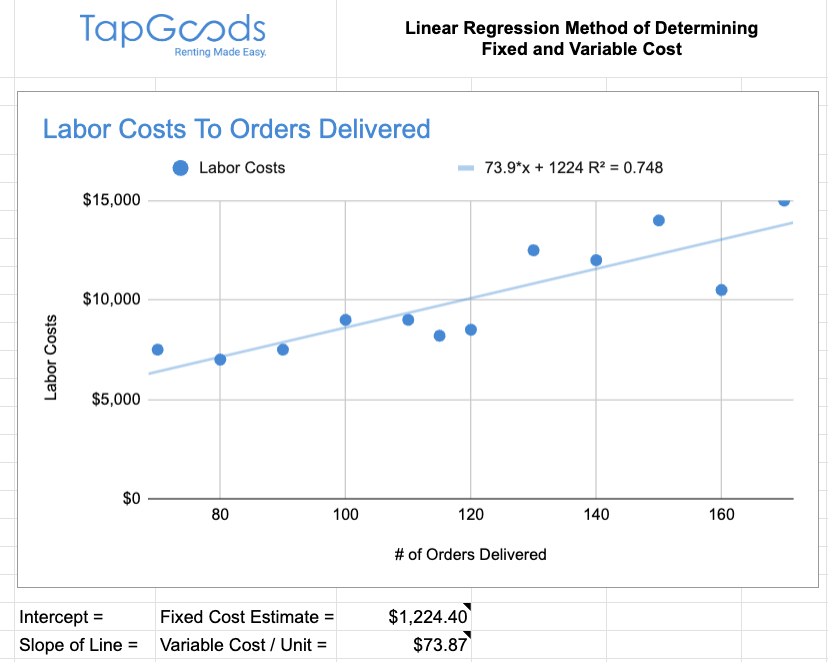

For a more precise data representation, the Linear Regression Method analyzes all your data points to establish the best fitting line, offering a clearer picture of your cost behavior.

Linear Regression Method

The Linear Regression Method, also known as Simple Ordinary Least Squares (OLS) Regression, uses all your data points (not just the highs and lows) to determine your fixed and variable costs.

The great news is you don’t need to do the math yourself; Excel and Google Sheets can handle it for you. The key to making informed pricing decisions lies in interpreting the results. I’ve prepared the formulas in Google Sheets, which is freely available to everyone, though Excel offers more advanced linear regression tools. If you prefer Excel, simply follow the instructions here.

To use Google Sheets, navigate to the second tab in the provided spreadsheet, labeled “Linear Regression Method.” Replace the sample data with your own, and the sheet will automatically update with your results.

Referencing the same data from our earlier example, you would see a scatter graph generated in the sheet, complete with a line that best fits your data points.

Here are three key metrics to focus on in your regression model:

- R-squared (R²) Value: Located at the top of the line graph area, the R² value shows how accurately the model predicts real-world outcomes. In our model, it gauges the correlation between the number of orders delivered and labor costs. For example, an R² value of .748 indicates a 74.8% accuracy in predicting labor costs based on the number of orders. The closer this value is to 100%, the more reliable the model. An R² of 0 suggests no correlation between the number of orders and costs.

- The Intercept (Fixed Cost Estimate): The intercept represents the expected total cost when there are no orders (x=0). It gives us the fixed costs, which are automatically calculated in the spreadsheet.

- The Slope (Variable Costs Per Unit): The slope indicates how costs vary with order volume. It measures the rate at which total costs change as the number of orders increases, providing a calculation of variable costs per unit directly in the spreadsheet.

While the high-low method allows for analyzing a single variable, the linear regression method can incorporate multiple variables for a more nuanced analysis. This is especially useful for assessing how fixed and variable costs might vary by the number of orders and time of year, for example, to adjust pricing seasonally. For multi-variable analysis, Excel is recommended over Google Sheets for its advanced capabilities.

To explore both methods, use the provided spreadsheet, which simplifies the calculations. Simply enter your data to see a breakdown of fixed versus variable costs.

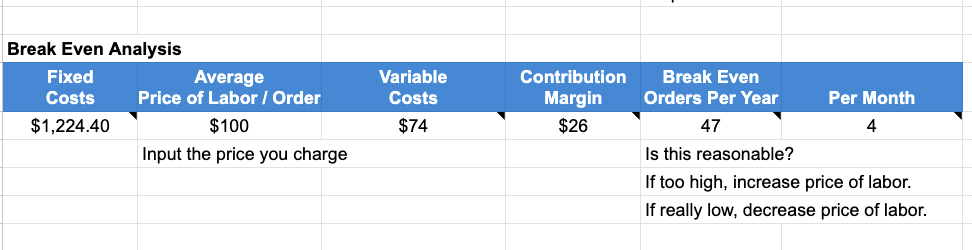

Break Even Analysis

The break-even section of the spreadsheet calculates how many units you need to sell to cover your fixed costs. The Contribution Margin represents your profit from each order after paying off your variable costs. For instance, if your labor charge is $100 and variable costs are $75, your contribution margin is $25.

You reach your break-even point when the number of orders covers all your fixed costs. In our high-low example, with fixed costs at $2,250 and a contribution margin of $25, it takes 90 orders to break even (90 x $25 = $2,250). Any orders beyond 90 bring in a profit of $25 each, since you’ve already met your fixed costs with the first 90 orders.

Understanding your contribution margin is crucial for maximizing profits.

How Much Should Rental Companies Charge for Labor?

Let’s quickly review the common types of pricing methods:

- Cost-Based: Now that you’re familiar with your costs and break-even point, you can apply a cost-based approach and include a profit margin.

- Customer-Based: Price your services based on what your customers are willing to pay.

- Competitor-Based: Set your prices by looking at what your competitors charge. You might choose to price lower to attract more business, higher to signal better value, or match competitors to neutralize price as a factor.

Combining all three methods is often the best strategy. Now that you know how much your labor costs, it’s time to add in some market insights.

Common Pricing Strategies

| Strategy | Description |

|---|---|

| Penetration Pricing | Initially set prices lower than competitors to capture market share. Used by newcomers to attract customers from established players. |

| Premium Pricing | Charge more than competitors to reflect the added value you provide, such as unique services that justify a higher price point. |

| Loss Leader Approach | Price certain items below cost to attract customers, making profits on additional purchases. E.g., low-priced tents with higher delivery and setup fees. |

| Skimming Strategy | Charge a high price for being the first to offer a specific service, until competition grows. Effective during high demand when supply is low. |

| Economy Pricing | Maintain a low profit margin, expecting volume sales to cover profits. Requires precise cost management to avoid losses. |

| Simplicity Pricing | Straightforward pricing, including potential extra fees, to enhance transparency and customer satisfaction. Inspired by Amazon's Prime service. |

| Skimming Strategy | Charge a high price for being the first to offer a specific service, until competition grows. Effective during high demand when supply is low. |

| Economy Pricing | Maintain a low profit margin, expecting volume sales to cover profits. Requires precise cost management to avoid losses. |

| Simplicity Pricing | Straightforward pricing, including potential extra fees, to enhance transparency and customer satisfaction. Inspired by Amazon's Prime service. |

Using the spreadsheet, play with the price you charge for labor and see how it affects your break-even point. You may choose to make changes such as using Total Labor Hours Billed instead of Number of Orders Shipped, which will help you determine what your hourly rate should be.

Set a Price, Then Analyze, Test, Adjust, and Repeat

To keep your business on track, it’s crucial to continually analyze, test, and adjust your prices. Don’t just set a price and forget about it. Mark your calendar to revisit your pricing strategy at least once every quarter, or at the very least, annually. Use your analysis, customer feedback, and a look at what your competitors are charging to refine your pricing approach.

Other blogs you may find helpful:

Hiring Top Talent for your Rental Business

Guide to Buying the Best Tables and Chairs

The Amazon Experience: 3 Key Takeaways for the Rental Industry

Frequently Asked Questions

Fixed costs are the expenses your business has that do not change, no matter how many products you rent out or services you provide.

This includes things like the rent for your shop and your employees’ salaries. On the other hand, variable costs depend on how much business you’re doing. For example, if you have to deliver more items, you’ll spend more on gas and maybe even pay for extra helping hands.

To calculate your fixed costs, add up all the expenses that stay the same each month, like rent, utility bills that don’t fluctuate much, and regular salaries you pay to your employees. These costs remain constant regardless of your business activity.

To figure out your variable costs, track expenses that change as your business volume changes. This includes materials, extra labor you need for busy times, and transportation costs for deliveries. Look at these costs over different times or seasons to see how they go up or down with your business activity.

The high-low method helps you understand your costs based on your busiest and slowest business periods. You take the costs from your highest and lowest activity months and use the difference to find out how much your spending changes with your business volume. This can give you a rough idea of your variable costs per unit and help identify your fixed costs.

Linear regression is a more detailed way to analyze your costs using all your data, not just the extremes. It uses a formula to predict your spending based on how your business activities change. This method is great because it considers all your information, giving you a clearer picture of how costs behave as your business grows or enters different seasons. It’s especially useful for planning your pricing strategy because it helps you see the real impact of changes in your business volume on your costs.

Protect Your Rental Business from Equipment Theft and Fraud

“In 2023, there were over 2,000 reports of equipment theft in the rental industry”

ARA

In the rental industry, equipment theft and fraud are significant issues, involving not just the physical theft of items but also deceptive practices like online scams and identity theft to acquire and then steal equipment unlawfully.

In this blog, we’ll define equipment theft and fraud, then discuss ways to prevent your business from becoming a victim in 2024.

Buckle up, ‘cause we’ve got lots to share!

- What is the Difference Between Equipment Theft and Fraud?

- Types of Equipment Theft

- Common Scams Targeting Rental Businesses

- Protecting Your Business from Equipment Theft and Fraud

- Already Experienced Equipment Theft or Fraud? Here’s What To Do!

- Resources & Tools

What is The Difference Between Equipment Theft and Fraud in the Rental Industry?

Both issues ultimately lead to theft of physical equipment or money, but what is the difference between theft and fraud in the rental industry?

- Equipment theft in the rental industry refers to stealing physical items from a business. This can be done by renting and not returning an item, taking unattended equipment without permission, or any other method of unlawfully acquiring equipment with the intent not to return it.

- Fraud involves deceitful tactics to acquire equipment or money, such as using someone else’s identity or fake information online. It’s about tricking the business into handing over items or funds under false pretenses, which can also lead to losing equipment or financial assets.

While these tactics often go hand-in-hand, it is important to understand the difference between the two, so that you can take precautions to protect your business. And you may be wondering, “Do I need to protect my rental business from theft?” Unfortunately, the answer is yes.

The National Equipment Register (NER) highlighted the seriousness of the problem, reporting over 2,000 cases of heavy equipment theft in a single year. This type of crime is particularly challenging because once equipment is stolen, recovering it is often difficult.

Types of Equipment Theft

Both issues ultimately lead to theft of physical equipment or money, but what is the difference between theft and fraud in the rental industry?

- Smash-and-Grab: This occurs when thieves physically break into a location to quickly steal equipment. It’s opportunistic, targeting items that are easily accessible, often because they are left unattended or in poorly secured areas.

- Identity Fraud: This involves the use of stolen or fake identities to rent equipment, which the criminal then never returns. It’s a deceptive practice that not only leads to the loss of equipment but can also involve financial theft if they use their identity to access credit or funds.

Equipment, especially heavy items like mowers and utility vehicles, is at high risk because these are frequently stored outside, which makes them easy targets for theft. But any item that is left unattended can be an easy target for this type of crime.

Rental businesses are particularly vulnerable to these types of theft due to the nature of their operations, highlighting the importance of enhanced security and verification processes.

Common Scams Targeting Rental Businesses

Identity Theft

This is when thieves use a fake identity to rent equipment, then disappear and sell the stolen goods online, making recovery difficult. If you search online, you’ll find tons of posts from disgruntled rental owners who have experienced this scam – and they never recovered their equipment.

Here’s how it works:

A scammer might use a stolen identity to rent an expensive piece of furniture, like a high-end bench or seating arrangement. They provide all the “necessary” documents, which are actually fake, and walk out with the item.

The next day, the vehicle is listed for sale on an online marketplace, like Craigslist or Facebook Marketplace. By the time the rental company realizes the deception, the scammer and the item are long gone, leaving the business with a significant loss and little hope of recovery.

Facebook Scams

If you advertise your rental business on Facebook, it is extremely important to be able to spot shady players on this site. There are TONS of scams out there, and they are not shy about targeting any user that will let them slide into their DM’s.

While there are specific scams out there that are well-known, there are always new scams in development. So, here are some red flags to look out for when talking to potential customers online:

- They are overly pushy. Scammers often use pressure tactics, hoping you won’t have time to spot the red flags or verify their identity.

- Their account doesn’t look legitimate. A poorly detailed or newly created account can indicate a scammer trying to remain anonymous and avoid detection.

- They request to communicate on a third-party app. Scammers prefer apps that make them more anonymous, making it harder for victims and authorities to track them down.

- They ask you to send them money. In the context of rental businesses, a scammer may attempt to overpay you, and request that you send them the difference back. NEVER do this! These funds are fraudulent, and you’ll be left holding the bag when the bank takes the fraudulent funds back.

- They ask for personal information. Scammers will fish for personal information or send you phishing links in an attempt to gather personal information. They use this information to steal from you or for other fraudulent activity.

If an account engages in any of the above behaviors, beware. It could be a scammer out to get your information.

Additionally, here are some specific scams we know of!

The “Zelle” Scam

The Zelle Facebook Marketplace Scam involves scammers contacting sellers about expensive items, offering to pay via Zelle. They send a fake payment notification or claim a higher subscription version of Zelle is needed (Hint: This doesn’t exist), tricking victims into sending money.

How it works:

A scammer expresses interest in an expensive item or rental listed on Marketplace, sends a fake Zelle payment confirmation, and asks the seller to refund the “extra” payment or pay for a premium Zelle service, leading to financial loss for the business.

IOU’s

In the “IOU” scam, a scammer agrees to pay for an item after receiving it but then disappears with the item, never making the payment.

How it works:

A scammer requests to take a utility vehicle with the promise to pay the next day. Once the item is in their possession, they end all communication and never return or pay, leaving the seller at a loss for both the rental and the item.

Overpayment

The overpayment scam involves scammers overpaying for orders using fraudulent methods, then requesting the excess be returned. This scam is particularly deceptive because the initial funds appear in your account, seeming legitimate, but are actually fraudulent. When you refund the excess money, you use real money.

Eventually, when the bank identifies the fraud, they withdraw the original amount, leaving you at a loss with the scammer taking the legitimate refund.

How this works with credit cards

A scammer pays for equipment rental with a stolen credit card, overpays, and asks for the difference to be refunded to a different card. Once the original transaction is flagged as fraudulent, the business loses the refunded money.

How this works with checks

A scammer sends a fake check for more than the rental cost, requests the surplus be returned, and disappears once the check bounces, leaving the business out the refunded amount.

Phishing

“Phishing” is a type of fraud that targets businesses by sending emails with attachments and links that contain malware or trick users into revealing personal information like passwords or credit card information. The malware attached to these emails allows scammers to gain access to passwords and/or sensitive financial information that can be used for fraudulent activity.

Here’s how it works

An employee at a rental equipment company receives an email claiming to be from their IT department, asking them to click a link to update their password due to a security breach.

Believing the email to be legitimate, the employee clicks the link, which leads to a fake login page. They enter their credentials, unknowingly giving a scammer access to the company’s inventory system.

This breach could lead to unauthorized access to the business’s and customers’ information and financial data.

Protecting Your Rental Business from Equipment Theft and Fraud

Preventing Equipment Theft

Although completely preventing equipment theft and fraud is not possible, rental businesses can implement strategies to reduce their risk and make their assets less attractive targets for criminals.

Verify a customer’s identity before handing over equipment.

Make sure that the person renting the equipment is who they say they are. You can do this by asking for identification like a driver’s license or state ID. Nowadays, it’s easier than ever to check the validity of a license or ID with technology! Always have your customers sign a rental agreement, which will legally protect your business.

Make deposits part of your rental process.

Require a deposit for rentals to ensure a financial commitment from the customer. Thieves are less likely to pay money upfront for an item, and these kinds of requirements will deter them from targeting your business.

Invest in visible security equipment, like cameras and alarms.

Investing in and visibly promoting your security systems, such as cameras and alarms, can deter potential thieves. Thieves typically aim for the easiest targets, and a business that visibly secures its equipment is less likely to be targeted than one without visible security measures.

Don’t leave equipment unattended.

This may seem obvious, but many thefts in the rental industry are items that were left unattended. If at all possible, put your valuable items inside at night. If you must leave equipment outside overnight, never leave the keys in a vehicle and lock them away in a safe spot inside.

Attach GPS trackers onto your valuable items.

If a piece of inventory is lost or stolen, a GPS tracker can help you track down the item and have it retrieved by law enforcement.

Insure your equipment.

Invest in insurance that covers equipment theft, so that your business is protected if an item cannot be recovered.

Preventing Fraud

Theft is scary, but most people are a lot more afraid of getting scammed online. For good reason! Once you’ve fallen for a scam or become a victim of fraud, it can be difficult to get your money back.

Luckily, there are a few great ways to spot scammers or discourage them from continuing to pursue your business:

Never agree to send an unverified customer money.

Generally, any customer that asks YOU for money that isn’t a refund for a purchase can already be written off as a scammer. Do not entertain any conversations in which a customer asks you to pay or send them back money for an overpayment.

Change your passwords frequently, and never use the same password twice.

And never share sensitive passwords with anybody!

Instill good online practices in your employees, like never clicking on links or attachments from outside sources.

Often, links from outside sources can contain malware that retrieves personal information about the user who clicks on it. Scammers may use this information to gain access to your business accounts, putting your business at risk for financial losses.

Already Experienced Theft or Fraud? Here’s What to Do

Alright, we’ve shared some great preventative tips, but what do you do if you’ve already experienced theft or fraud?

What If Your Rental Equipment is Stolen?

- Report the incident to the police. This is, by far, the most important step if you want to have any shot at recovering your equipment. The sooner you do this, the better chance police have of finding the item before it is sold off. Additionally, many insurance companies will want to see that you filed a police report before paying out for your equipment if it cannot be recovered.

- Gather proof of ownership. If your equipment is recovered, you need to be able to prove beyond a shadow of a doubt that it is yours. Find any paperwork confirming that you purchased the unit, including receipts and serial numbers.

- Check Pawn Shops, Facebook Marketplace, Craigslist, and Ebay. Many thieves will turn around and sell the stolen item online. See if your item is listed online and if you find it, notify authorities immediately.

- If the item cannot be recovered, make an insurance claim.

What If Your Rental Business Gets Scammed?

- Notify your bank IMMEDIATELY. If sensitive information, like banking information, has been compromised and you notice unverified activities on your financial accounts, immediately notify your bank. The bank will freeze the credit card or account, and minimize any further damage.

- Report the incident to the police. After you have frozen the account, report the incident to the police.

Resources & Tools

ID Verification Tools

GPS Tracking Software for Equipment

Insurers for Rental Equipment

Training Resources for Online Safety

Ultimately, Prevention is Key!

Although you can take action once theft has happened, it is better to take a proactive approach to preventing theft and fraud. Always remember to keep your inventory under lock-and-key, and utilize smart online practices to prevent your business from being victimized by scammers.

By taking these preventative measures, you’ll be less likely to experience theft or falling victim to a scam.

Other blogs you may find helpful:

Hiring Top Talent for your Rental Business

Optimizing Warehouse Operations for Maximum Efficiency

The Importance of Equipment and Party Rental Contracts in 2023

Frequently Asked Questions

Although completely preventing equipment theft and fraud is not possible, rental businesses can implement strategies to reduce their risk and make their assets less attractive targets for criminals.

- Verify a customer’s identity before handing over equipment. Make sure that the person renting the equipment is who they say they are. You can do this by asking for identification like a driver’s license or state ID. Nowadays, it’s easier than ever to check the validity of a license or ID with technology!

- Make deposits part of your rental process. Require a deposit for rentals to ensure a financial commitment from the customer. Thieves are less likely to pay money upfront for an item, and these kinds of requirements will deter them from targeting your business.

- Invest in visible security equipment, like cameras and alarms. Investing in and visibly promoting your security systems, such as cameras and alarms, can deter potential thieves. Thieves typically aim for the easiest targets, and a business that visibly secures its equipment is less likely to be targeted than one without visible security measures.

- Don’t leave equipment unattended. This may seem obvious, but many thefts in the rental industry are items that were left unattended. If at all possible, put your valuable items inside at night. If you must leave equipment outside overnight, never leave the keys in a vehicle and lock them away in a safe spot.

- Attach GPS trackers onto your valuable items. If a piece of inventory is lost or stolen, a GPS tracker can help you track down the item and have it retrieved by law enforcement.

- Insure your equipment. Invest in insurance that covers equipment theft, so that your business is protected if an item cannot be recovered.

When equipment is stolen from a business, time is of the essence. Immediately report the incident to the police and your insurance. If you report the theft as soon as possible, the likelihood of recovering the equipment is much higher.

Many thieves will turn around and sell the stolen item online. See if your item is listed online and if you find it, notify authorities immediately.

If your equipment is recovered, you need to be able to prove beyond a shadow of a doubt that it is yours. Find any paperwork confirming that you purchased the unit, including receipts and serial numbers.

Yes! The first thing you should do if anything was stolen from your business is file a police report. Do this as soon as possible, as thieves will often turn around and sell stolen goods. Once the item is sold, it becomes much more difficult to track down.

Thieves aren’t usually out to keep items they’ve stolen – they steal them so that they can sell them. Thieves will often list stolen equipment on sites like Facebook Marketplace, Craigslist, and eBay.

Guide to Buying the Best Tables and Chairs

“Party rental companies enjoy a 10-15% profit margin, which is higher than the average retail business.”

TapGoods

Whether a customer is hosting a birthday party, corporate meeting, wedding, or family reunion, they will almost always need tables and chairs. This is a profitable window of opportunity for entrepreneurs who want to rent out event equipment. But if you’re just getting started, you may be wondering how to pick the best tables and chairs for your rental business.

Whether you’re just starting or want to expand your inventory, we’ve covered you in this guide to the best tables and chairs! In this blog, we’ll explore the profitability of renting chairs and tables, the most common types, where to buy the best tables and chairs, and how to charge a fair rate for your rentals.

Let’s get started!

- Are tables and chairs worth the investment?

- What are the most common types of tables and chairs?

- How do I choose the best tables and chairs for my business?

- Where to buy the best tables and chairs

- How much should I charge for tables and chairs?

Are tables and chairs worth the investment?

If you’re just getting started with renting out inventory, you may be strapped for cash or feeling picky about what types of inventory you want to invest in. For small businesses that are just getting started, tables and chairs are an essential investment that you want to make available to your customers.

If you’re wondering whether tables and chairs are a worthwhile investment for your rental business, the answer is a resounding “yes”! Everyone needs a place to sit down, relax, and enjoy the event. And where do they put all the food, drinks, and decorations? On tables, of course! That’s why tables come in as the second most rented item after chairs, forks, knives, and plates. Imagine going to a party and having no place to sit or eat. It just wouldn’t work!

Tables and chairs are a basic need for every event, and having those in your inventory opens doors to more rental opportunities. Once a customer sees that you can meet their basic needs, they’ll be more inclined to find out what other kinds of inventory you carry. And if you carry all the inventory your customers need, they’re more likely to use your business’s services since it is more convenient.

Additionally, since they are in high demand, tables and chairs are items that have a great return on investment (ROI) potential. We’ll talk more about this later!

What are the most common types of tables and chairs?

Common Types of Chairs

| Chair Type | Description | Commonly Used For... |

|---|---|---|

| Poly Chair | Also known as a folding chair. Usually made out of plastic and are easily stackable. | Birthday parties, school carnivals, and other casual events. |

| Resin Chairs | Sturdier than a typical folding chair. These usually are rented with cushions for added comfort. | Weddings, parties, concerts, banquets, receptions. |

| Chiavari Chairs | Elegant chairs with unique designs; they can be made out of resin, plastic, or aluminum. | Versatile; used in events like weddings, receptions, and more. |

Common Types of Tables

| Table Type | Description | Commonly Used For... |

|---|---|---|

| Cocktail Tables | Small tables that come in different heights and sizes. Typically, they are 24-30 inches in diameter and 30-42 inches tall. | Versatile and used for all kinds of semi-casual and formal events. |

| Round Tables | Larger, round tables used for large groups of people to sit and socialize. Typically, they are 60-72 inches in diameter. | Typically used for formal events like weddings, dinners, and fundraisers. |

| Rectangle (Straight) Tables | Long, rectangular tables that are typically made out of wood or plastic. | Used for casual events like birthday parties, school carnivals, and picnics. |

How do I choose the best tables and chairs for my business?

If you’re just getting started with tables and chairs, you may be wondering “What are the best tables and chairs for my business?”

Well, it depends on what your target audience is. Renting tables and chairs to a children’s party is different from renting them to a wedding vendor. So, if you’re wondering which ones are the best for your customers, consider your target audience.

Are you an inflatables company that typically rents for birthday parties, family reunions, or school carnivals? If this is the case, you should invest in plastic folding chairs and rectangular tables. Since these are more casual events, customers hosting them are unlikely to spend money on expensive, fancy chairs like Chiavari chairs.

On the other hand, if you’re aiming to rent out to weddings or fancy corporate events, you’ll want to think about stocking up on resin chairs, Chiavari chairs, cocktail tables, and round tables. These events often have a bigger budget for making things look extra special, and the people planning them are looking for that touch of elegance that makes their event stand out. And if you’re renting out to fancier events like weddings, consider investing in linens and quality tableware that will make your items pop.

Remember, the best tables and chairs for your customers are the ones that match the kind of events they’re throwing. If they’re planning something laid-back and fun, they’ll love those easy-to-move plastic options. But if they’re putting together an event that’s all about luxury and style, they’ll be looking for something a bit more upscale.

Where to buy the best tables and chairs

So, how do you find the best place to buy tables and chairs? You look for shops that sell things in large amounts and have great reviews from other customers. When you search “where to purchase chairs and tables wholesale,” choose sellers with 4 stars or more; they should have lots of different chairs and tables to choose from.

It’s also a good idea to check if there are any places nearby where you can buy what you need. It’s great if you can find a good seller close to you because it might save you some money on getting your tables and chairs delivered. But, here’s the thing: don’t just pick a place because it’s close. Make sure their chairs and tables are good, too. You want your stuff to last long and look good for your customers’ events.

Here are some reputable vendors online that sell quality tables and chairs:

How much should I charge for tables and chairs?

Market Rate Prices for Chairs

| Chair Type | Average Price |

|---|---|

| Poly | $1.00-$1.50 per chair |

| Resin/Wood | $3.00 per chair |

| Chiavari | $7.00 per chair |

Market Rate Prices for Tables

| Table Type | Average Price |

|---|---|

| Cocktail Tables | $8.00-$12.00 depending on size |

| Round Tables | $6.00-$9.00 depending on size |

| Rectangle (Straight) Tables | $7.00-$12.00 depending on size |

Setting Competitive & Profitable Prices

When you set prices for your table and chairs, research your competitors. What are their prices? Can you set a better price and still make money? If you can offer a better deal, you’ll likely attract more customers. Be careful about pricing items TOO low, though, because prices that are too low can indicate to customers that your products might be bad quality.

There is no one-size-fits-all solution to pricing; it all depends on the market and your business’s individual needs. Once you’ve set your prices, keep an eye on how your customers respond. Are orders flooding in, or are customers hesitating to order? Are you getting pushback on your prices? Ask your customers for feedback, and eventually you will be able to use this information to decide whether you need to raise or lower your prices.

One great thing to consider is peak seasons and how they can affect impact on pricing. The demand for tables and chairs changes throughout the year. For example, summer is considered a peak season for weddings, graduations, and other school events. During this time, you may be able to adjust prices higher to account for higher demand. But during slower months, you may need to adjust lower to attract customers.

Setting prices for your inventory is a bit of a push-pull game, you’ll always be adjusting them. Overall, you always want to send the message to customers “Hey, I have the best tables and chairs AND I’ll give you the best deal” without compromising on profits.

Ready to get started?

Tables and chairs are some of the most popular items to rent, so if you’re just getting started or looking to invest in new inventory, these are a great choice to get started with! Just remember, quality and customer satisfaction are key to building a successful rental business. By offering the best quality, you’re not just providing furniture; you’re helping create memorable moments for your customers’ special occasions.

Also, don’t forget to keep an eye on your inventory. Make sure all of your items are always in top condition. A quick check before and after events can save you from unexpected surprises and keep your reputation high with customers!

Finally, remember that running a rental business isn’t all about profits. Renting out the best items available to your customers serves as the foundation to many people’s happiest days. Enjoy it and take pride in what you do.

Other blogs you may find helpful:

Best Practices for Pricing Rental Inventory with a Calculator

5 Reports that Rental Businesses NEED to Review Frequently

The Importance of Equipment and Party Rental Contracts in 2023

Frequently Asked Questions

Usually, businesses rent out plastic folding chairs for about $1 to $2 each. Chairs that are a bit nicer, like those made from resin or wood, might cost around $3 each to rent. For elegant chairs, such as Chiavari chairs, the cost could be around $7 to $8 for each chair. The price changes based on style, what material it’s made of, and the demand for the chair.

The cost to rent tables varies depending on their size and type. Cocktail tables, which are smaller and often used at parties and receptions, might be rented out for about $8 to $12 each. Larger round tables, which are common at weddings and formal dinners, could cost between $6 to $9 each, depending on their size. Long, rectangular tables, used for more casual events, might have a rental price of around $7 to $8 for a 6-foot table, and larger square tables might go for about $12 each.

Yes, renting out tables and chairs can be a very profitable business. These items are always in demand for various events like parties, weddings, and meetings, making them a steady source of income. This high demand can lead to a good return on investment (ROI) for these items, especially since they can be used repeatedly over many years.

A Tiffany chair is just another name for a Chiavari chair. These are very stylish and elegant chairs that you might see at weddings, fancy parties, or formal events. Chiavari chairs can be made from different materials like resin, plastic, or aluminum and come in various colors and styles.

A Poly Chair refers to a type of folding chair that’s usually made out of plastic. Poly Chairs are a great choice for more casual events like birthday parties, school carnivals, or outdoor gatherings where you need a lot of seating but also need to be able to clean up quickly and easily afterward. They’re durable, lightweight, and are easy to stack.